Use the following information and the percent-of-sales method to answer the following question(s) .

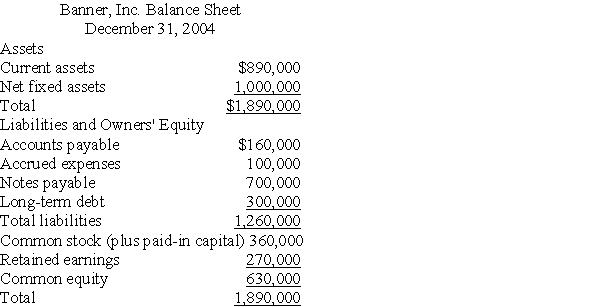

Below is the 2004 year-end balance sheet for Banner,Inc.Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005.In addition,we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales.(For consistency with the Answer selections provided,round your forecast percentages to two decimals. )

-Banner's projected accounts payable balance for 2005 is:

Definitions:

Private Placement

The sale of securities or investment instruments directly to a select group of investors rather than through a public offering.

Public Offering

The process of offering shares of a private corporation to the public in a new stock issuance, allowing the company to raise capital from public investors.

Confidential

Information that is meant to be kept secret or private between the parties involved, often due to its sensitive nature.

Disclosure

The act of making known or public; in legal and business contexts, it often involves the revealing of previously private information.

Q14: The capital structure that minimizes the weighted

Q17: EG's board of directors announced a quarterly

Q19: Pledging accounts receivable as a source of

Q30: When calculating the weighted average cost of

Q46: Briefly identify and describe some important uses

Q48: Which of the following would NOT typically

Q61: An investor purchased 1,000,000 Canadian dollars at

Q68: Zybeck Corp.projects operating income of $4 million

Q90: What motivates users of raw materials to

Q117: If Quick Corp.foregoes the discount and pays