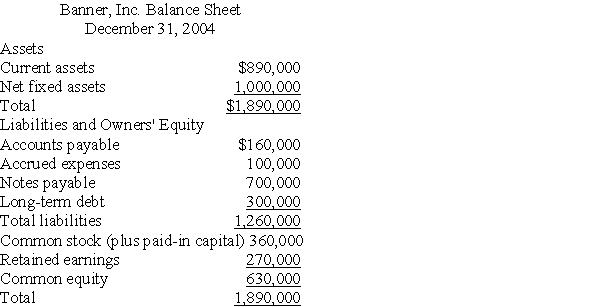

Use the following information and the percent-of-sales method to answer the following question(s) .

Below is the 2004 year-end balance sheet for Banner,Inc.Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005.In addition,we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales.(For consistency with the Answer selections provided,round your forecast percentages to two decimals. )

-Banner's projected long-term debt for 2005 is:

Definitions:

Q34: Real options can have the effect of:<br>A)increasing

Q40: When new capital must be raised for

Q53: The "pure play" approach to estimating a

Q61: An investor purchased 1,000,000 Canadian dollars at

Q65: Optimal capital structure is:<br>A)the funding mix that

Q71: Large firms are most likely to adjust

Q71: Assume that the interest rate in India

Q102: Forward rates are quoted:<br>A)in direct form.<br>B)in indirect

Q114: Flotation costs are usually ignored when computing

Q128: Which of the following statements regarding a