Use the following information and the percent-of-sales method to answer the following question(s) .

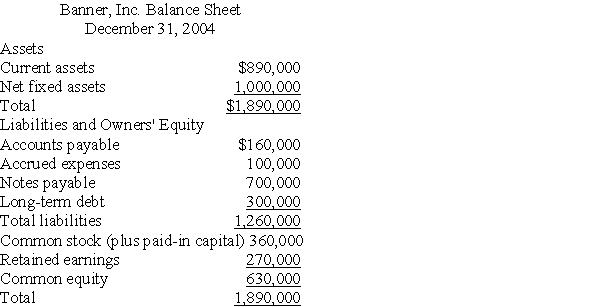

Below is the 2004 year-end balance sheet for Banner,Inc.Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005.In addition,we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales.(For consistency with the Answer selections provided,round your forecast percentages to two decimals. )

-Banner's projected fixed assets for 2005 are:

Definitions:

Asymmetrical Mass

An architectural or sculptural term denoting a structure or form that lacks symmetry, often resulting in an uneven distribution of visual weight or interest.

Imbalanced Forms

Artistic compositions or structures that deliberately avoid symmetry to create dynamic, often unsettling effects.

Densified Scrap Metal

A process that compacts and consolidates scrap metal to facilitate easier recycling and transportation.

Edward Burtynsky

A Canadian photographer known for his large-scale, industrial landscapes that reflect the impact of human activity on the planet.

Q9: A direct quote in Bombay tells one

Q12: Moore Financing Corporation has preferred stock in

Q13: Participants in foreign exchange trading include:<br>A)importers and

Q39: When a commercial bank extends short-term credit

Q54: Company managers strive to gradually increase dividend

Q69: Holding other things constant,a firm's "discretionary financing

Q88: A partnership agreement may be oral.

Q96: The primary advantage that factoring accounts receivable

Q114: Flotation costs are usually ignored when computing

Q201: An individual partner's signing of a contract