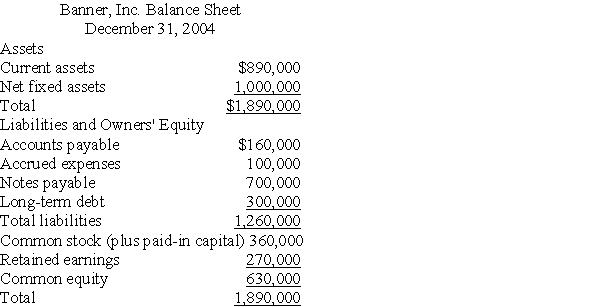

Use the following information and the percent-of-sales method to answer the following question(s) .

Below is the 2004 year-end balance sheet for Banner,Inc.Sales for 2004 were $1,600,000 and are expected to be $2,000,000 during 2005.In addition,we know that Banner plans to pay $90,000 in 2005 dividends and expects projected net income of 4% of sales.(For consistency with the Answer selections provided,round your forecast percentages to two decimals. )

-Banner's projected long-term debt for 2005 is:

Definitions:

Decimal Number

A number expressed in the base 10 numeral system, which consists of digits 0 to 9 and uses a decimal point to represent fractions.

Valid Statement

A well-formed instruction that adheres to the grammar and syntax rules of the programming language in which it is written.

Java.swing

A GUI (Graphical User Interface) widget toolkit for Java that allows the creation of window-based applications.

Q13: Which of the following is most likely

Q33: Net working capital provides a very useful

Q37: Net present value break-even is reached:<br>A)after the

Q56: According to the pecking order theory of

Q62: T-bills and Treasury bonds are guaranteed by

Q91: Miniature Molding is planning to introduce a

Q92: Break-even NPV means that the expected rate

Q94: The cost of common equity is usually

Q97: Transaction costs:<br>A)encourage firms to retain earnings rather

Q98: Transactions carried out in the foreign exchange