Parent Corporation paid $100,000 to acquire all the common shares of Subsidiary Inc.on December 31,2017.At that date,Parent Corporation also had an outstanding note payable to Subsidiary Inc.in the amount of $60,000.

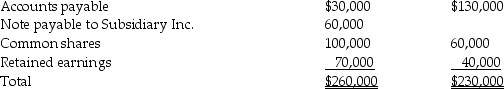

Assume that Parent Corporation and Subsidiary Inc.had the following account balances at December 31,2017 (immediately after the investment):

Liabilities and shareholders' equity:

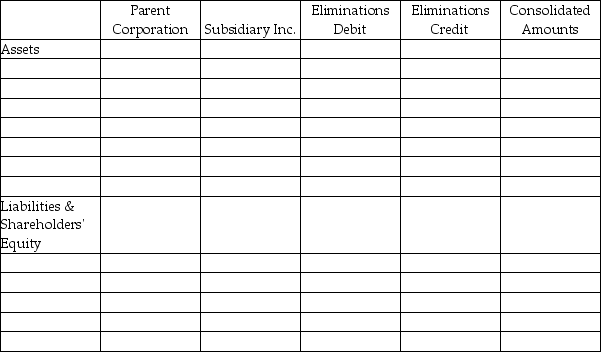

Using the worksheet provided below calculate the Consolidated Amounts for December 31,2017.

Using the worksheet provided below calculate the Consolidated Amounts for December 31,2017.

Definitions:

Vitamin K

A fat-soluble vitamin that plays a key role in blood clotting and bone metabolism.

DA Equation

A mathematical equation or formulation that follows specific rules or styles, possibly differentiated algebraically or in the context of differential analyses.

Estimated Dose

A calculated approximation of the amount of medication or drug required for a desired therapeutic effect.

Measurable Dose

An amount of medication that can be precisely measured or quantified, ensuring accurate administration of drugs.

Q2: Diteck Corporation is considering two plans for

Q58: A short-term investment cost $22,000 on March

Q67: Refer to Table 18-5.On a vertical analysis,what

Q69: Which of the following is a correct

Q69: Referring to Table 16-3,the investment in common

Q129: Refer to Table 17-6.Prepare the operating activities

Q138: Refer to Table 17-4.Prepare a statement of

Q166: Managerial accounting focuses on providing information for

Q174: The shareholders' equity of Saturn Corporation

Q178: A foreign currency transaction gain or loss