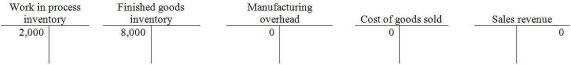

At the beginning of 2015, Conway Manufacturing had the following account balances:  Following additional details are provided for the year: The ending balance in the Work-in-Process Inventory account is a:

Following additional details are provided for the year: The ending balance in the Work-in-Process Inventory account is a:

Definitions:

Altered Visual Perception

refers to changes in how visual information is interpreted by the brain, potentially causing illusions or misinterpretations of visual stimuli.

MDMA

A psychoactive drug primarily used for recreational purposes, known for its effects on mood, perception, and energy, also known as ecstasy or Molly.

Cocaine

A powerful stimulant drug derived from the leaves of the coca plant, known for its addictive properties and illegal status in many countries.

Limbic System

A complex system of nerves and networks in the brain, involved in instinct and mood. It controls the basic emotions (fear, pleasure, anger) and drives (hunger, sex, dominance, care of offspring).

Q29: Under process costing, the total production costs

Q52: One of the assumptions of cost-volume-profit (CVP)

Q102: Purely Pizza Company sells pizzas in two

Q110: <br>Colin is planning to increase the selling

Q113: Dexter Accounting expects its accountants to work

Q122: From the graph given below, identify the

Q145: A 15% increase in production volume will

Q155: Assume for Down Corporation that current assets

Q172: Canfield Corporation reports net income of $600,000

Q176: Comcast Corporation reports dividends per share in