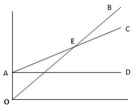

From the graph given below, identify the fixed costs line.

Definitions:

Payroll Tax

Taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff.

Social Insurance Tax

Taxes imposed on employees and employers to fund public insurance programs, such as social security, health care, and unemployment benefits.

Social Security

Social Security is a government system that provides financial assistance to people with an inadequate or no income, primarily the elderly, disabled, and survivors.

Income Support

Government-provided financial assistance aimed at ensuring individuals can meet a minimum standard of living.

Q27: Which of the following describes a system

Q31: Total variable costs change in direct proportion

Q35: A company has prepared the operating budget

Q36: Gardner Machine Shop estimates manufacturing overhead costs

Q50: What is the cost per letter

Q70: Variable costing cannot be used for preparing

Q86: When a company produces more units than

Q95: Star Health Inc. is a fitness

Q105: Budgeted financial statements are financial statements based

Q135: Nevada Manufacturing has two processing departments, Department