The accounting records of Marcus Service Company include the following selected,unadjusted balances at June 30: Accounts Receivable,$2,700; Office Supplies,$1,800; Prepaid Rent,$3,600; Equipment,$15,000; Accumulated Depreciation - Equipment,$1,800; Salaries Payable,$0; Unearned Revenue,$2,400; Office Supplies Expense,$2,800; Rent Expense,$0; Salaries Expense,$15,000; Service Revenue,$40,500.

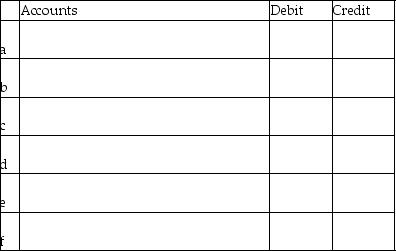

The following data developed for adjusting entries are as follows:

a.Service revenue accrued,$1,400

b.Unearned Revenue that has been earned,$800

c.Office Supplies on hand,$700

d.Salaries owed to employees,$1,800

e.One month of prepaid rent has expired,$1,200

f.Depreciation on equipment,$1,500

Journalize the adjusting entries.Omit explanations.

Definitions:

Investments

Assets purchased with the expectation that they will generate income or will appreciate in the future.

Net Income

The total revenue of a company minus the total expenses, indicating the profit earned over a specific period.

Organizational Expenses

Costs incurred during the formation of a corporation, partnership, or any business entity, such as legal and administrative fees.

Intangible Assets

Non-physical assets such as patents, trademarks, and goodwill that have value to a business.

Q4: The post-closing trial balance shows the net

Q6: Which of the following affects the company's

Q10: Which of the following accounts will be

Q71: The following details are provided by

Q87: GAAP requires publicly traded companies to prepare

Q112: Henderson Products is a price-setter that uses

Q115: Discounted cash flow methods,such as net present

Q125: The beginning balance in the Retained Earnings

Q125: In the case of deferred revenue,the adjusting

Q200: If purchase allowances are granted,the buyer need