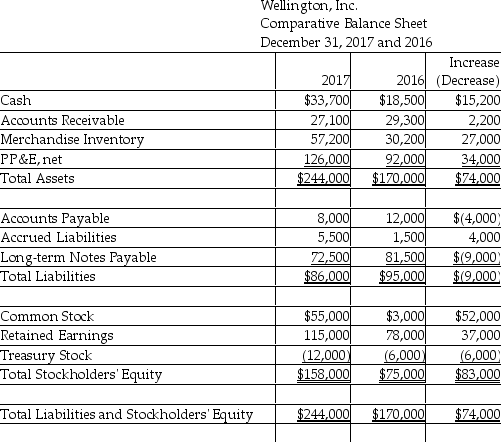

Wellington,Inc.uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2017:

Definitions:

Horizontal Analyses

Analysis technique for financial statements that evaluates changes in financial information over multiple reporting periods using percentage or absolute comparisons to find growth or decline trends.

Financial Statements

Reports that summarize the financial performance and position of a business, including the balance sheet, income statement, and cash flow statement.

Current Ratio

A measure used to evaluate a company’s liquidity and short-term debt-paying ability; computed by dividing current assets by current liabilities.

Vertical Analysis

A financial statement analysis method where each entry for each category is listed as a percentage of a base figure within the statement.

Q35: Arturo Sales purchased some equipment for $12,000

Q37: Which of the following actions could increase

Q61: Extra compensation items that are not paid

Q73: The Frozen Lake Company issues $503,000 of

Q83: Buying property,plant,and equipment for cash is considered

Q117: Berkley's gross pay for the month is

Q135: Rocco earns $14.50 per hour for straight

Q151: Unlike cash dividends,which are optional payments to

Q155: Applied Foods Corp.had cash sales of $598,000

Q181: Manufacturing overhead includes indirect manufacturing costs,such as