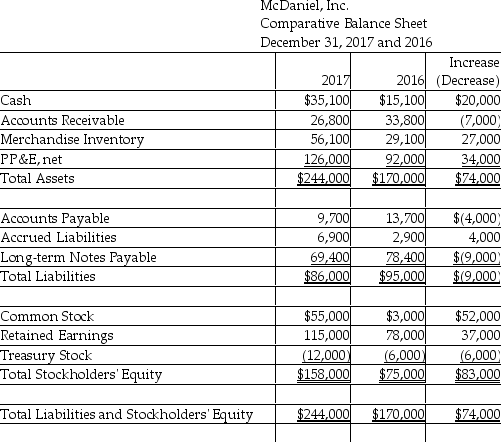

McDaniel,Inc.uses the direct method to prepare its statement of cash flows.Refer to the following financial statement information for the year ended December 31,2017:  Use the direct method to compute the payments made to employees.(Accrued Liabilities relate to other operating expense. )

Use the direct method to compute the payments made to employees.(Accrued Liabilities relate to other operating expense. )

Definitions:

Auditory Tube

A tube connecting the middle ear to the nasopharynx, helping equalize pressure on either side of the eardrum.

Pharynx

The pharynx is a muscular tube that connects the mouth and nasal passages with the esophagus and larynx, serving both respiratory and digestive functions.

Ossicles

Small bones, especially those in the middle ear that include the malleus, incus, and stapes, which transmit sound vibrations.

Eardrum

A thin membrane that separates the outer ear from the middle ear and vibrates in response to sound waves.

Q24: Which of the following sections of the

Q28: A corporation originally issued $13 par value

Q40: Use the balance sheet of Detroit,Inc.to

Q71: Stephens,Inc.had 140,000 shares of $5 par value

Q81: Amber Corporation has provided the following

Q95: To accurately determine the financial performance of

Q119: Which of the following accounts will be

Q122: Which of the following sections of the

Q148: On January 1,2017,Damron Services issued $20,000 of

Q187: The following information relates to Washington,Inc.: