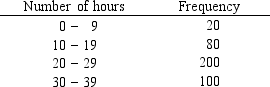

Exhibit 2-1

The numbers of hours worked (per week) by 400 statistics students are shown below.

-Refer to Exhibit 2-1. If a cumulative frequency distribution is developed for the above data, the last class will have a cumulative frequency of

Definitions:

Deferred Tax Liability

A tax obligation that is recorded on the balance sheet but not yet due, arising from temporary differences between the accounting and tax treatment of transactions.

Temporary Differences

Differences between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in the future.

Taxable Income

The amount of income used to calculate how much the entity owes in taxes to the federal, state, and/or local government.

Pretax Financial Income

The income of a company before taxes are deducted, often used in financial reporting and analysis.

Q6: Whenever the probability is proportional to the

Q34: In the textile industry, a manufacturer is

Q40: Refer to Exhibit 5-2. The expected daily

Q57: Guests staying at Marada Inn were asked

Q59: An insurance company has determined that each

Q60: Medbam,Inc.has collected the following data.(There are

Q72: Which of the following financial statements is

Q96: Financial statements are prepared after an entity's

Q105: A random variable x has the following

Q113: Which of the following is true of