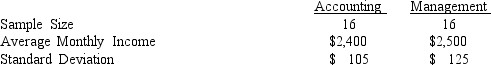

We are interested in determining whether or not the variances of the starting salaries of accounting majors is significantly different from management majors. The following information was gathered from two samples:  At a 5% level of significance, test to determine whether or not the variances are equal.

At a 5% level of significance, test to determine whether or not the variances are equal.

Definitions:

Stockholders' Equity

The residual interest in the assets of a corporation after all liabilities have been deducted, often referred to as shareholder's equity or owners' equity.

Accounts Receivable

Unpaid amounts by customers for products or services they have obtained from a company.

Customer Payments

Funds received from customers as payment for goods or services provided.

Credit Sales

Sales made by a business where payment is deferred to a later date, typically documented by an invoice.

Q13: If a hypothesis is rejected at a

Q14: Refer to Exhibit 7-2. The point estimate

Q28: As a general rule, the sampling

Q33: For inventory purposes, a grocery store manager

Q49: The least squares criterion is<br><br><br>A)<img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2162/.jpg" alt="The

Q61: In multiple regression analysis, the word

Q67: Refer to Exhibit 15-3. The coefficient of

Q70: The mean of the t distribution is<br>A)0<br>B).5<br>C)1<br>D)problem

Q75: In regression analysis, an outlier is an

Q107: A population has a mean of 180