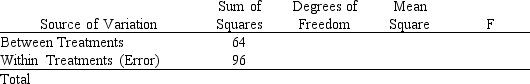

Exhibit 13-7

The following is part of an ANOVA table, which was the results of three treatments and a total of 15 observations.

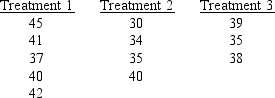

-Random samples were selected from three populations. The data obtained are shown below.  At a 5% level of significance, test to see if there is a significant difference in the means of the three populations. (Please note that the sample sizes are not equal.)

At a 5% level of significance, test to see if there is a significant difference in the means of the three populations. (Please note that the sample sizes are not equal.)

Definitions:

Fixed Manufacturing Cost

Costs that do not change with the level of manufacturing activity, such as rent for a factory building or salaries of permanent staff.

Manufacturing Overhead

All indirect costs associated with the production process, like utilities and salaries for support staff.

Fixed Cost

A type of business expense that does not change with the level of production or sales, including costs like rent, salaries, and insurance premiums.

Variable Cost

Costs that fluctuate directly with changes in production or sales volume.

Q6: Do the following data indicate that

Q13: Part of an ANOVA table is

Q16: Regional Manager Sue Collins would like

Q29: The following regression model y =

Q29: If the coefficient of correlation is 0.8,

Q65: Random samples of individuals from three

Q69: Refer to Exhibit 18-4. The test statistic

Q78: A regression analysis between sales (y in

Q101: Refer to Exhibit 15-1. The computed F

Q106: The following is part of the