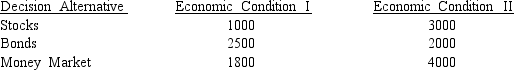

Assume you have a sum of money available that you would like to invest in one of the three available investment plans: stocks, bonds, or money market. The conditional payoffs of each plan under two possible economic conditions are shown below. The probability of the occurrence of economic condition I is 0.28.

a.Compute the expected value of the three investment options. Which investment option would you select, based on the expected values?

b.Compute the expected value with perfect information (i.e., expected value under certainty).

c.Compute the expected value of perfect information (EVPI).

Definitions:

Net Operating Loss

The deficit that occurs when a business's expenses exceed its revenues, excluding taxes and certain other expenses, over a fiscal period.

Future Profitability

An estimation or outlook on the capacity of a business to generate earnings in future periods, often considered for investments or strategy planning.

Deferred Tax Asset

A tax amount that is paid or carried forward, representing future tax savings due to overpayment or advance payment of taxes, or due to allowable temporary differences.

Valuation Allowance

An allowance made against deferred tax assets that are not expected to be realized in full or in part.

Q20: The major role in the body that

Q24: In order to estimate the difference between

Q25: Refer to Exhibit 21-2. The population total

Q32: Which of the following strategies should be

Q47: The following information regarding the number of

Q53: The following data show the test

Q54: The stomach's main function is the digestion

Q56: The prices of Rawlston, Inc. stock (y)

Q69: Good food choices can reduce the chance

Q80: Heart disease deaths have fallen substantially and