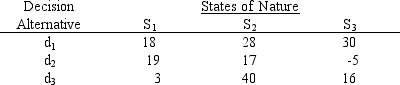

Suppose we are interested in investing in one of three investment opportunities: d1, d2, or d3. The following profit payoff table shows the profits (in thousands of dollars) under each of the 3 possible economic conditions: Sl, S2, and S3. The probability of the occurrence of S1 is 0.1, and the probability of the occurrence of S2 is 0.3.

a.Determine the expected value of each alternative and indicate which decision alternative is the best.

b.Determine the expected value with perfect information about the states of nature.

c.Determine the expected value of perfect information.

Definitions:

Risk Management Strategy

A process of identifying, assessing, and controlling threats to an organization's capital and earnings.

Net Exposure Basis

A method of measuring risk that combines both the gross positive and negative positions to determine an entity's overall exposure.

Equity Instrument

A type of financial security that signifies ownership in a company and represents a claim on part of the company's assets and earnings, such as stocks.

Market Participant

An entity or individual with the willingness and ability to buy, sell, or otherwise engage in transactions in a market.

Q3: A variable that cannot be measured in

Q8: A regression analysis was applied in

Q24: Consider the following data. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2162/.jpg"

Q37: How many calories are provided by a

Q42: Refer to Exhibit 16-1. The model<br>A)is significant<br>B)is

Q59: A group of items such as incoming

Q64: Refer to Exhibit 16-2. The degrees of

Q65: Some nutrients are stored in the body

Q66: Every check cashed or deposited at Lincoln

Q78: An advertisement for a new performance-enhancing supplement