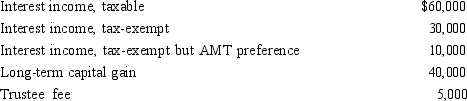

The Kapoor Trust is your client. Complete the chart below, indicating Kapoor's trust accounting income for each of

the alternatives.

Trust agreement provisions Trust accounting income

Trust agreement provisions Trust accounting income

Fees and capital gains allocable to corpus ______________________

Capital gains allocable to corpus, one-half of fees

allocable to income ______________________

Capital gains allocable to income, silent

concerning allocation of fees ______________________

Fees and exempt income allocable to corpus,

silent concerning allocation of capital gain/loss ______________________

Definitions:

Equity Method Investment

A financial recording method for investments in other firms where the investor holds considerable influence without exerting complete control.

Consolidated Income Statement

A financial statement that combines the income statements of a parent company and its subsidiaries, showing the overall performance.

Step Acquisition

The process of acquiring control of another company in stages over time, rather than all at once.

Noncontrolling Interest

A minority stake in a company, where the stake does not afford the investor enough influence to dictate corporate policy.

Q6: A trust whose remainder beneficiary is its

Q16: Describe the algorithm that defines Johnson's sequencing

Q43: The purpose of the master schedule is

Q48: The Gap model helps managers to analyze

Q57: The election by an estate of §

Q90: Jacob makes a gift of property (basis

Q113: Georgia owns an insurance policy on the

Q115: List the three major functions of distributable

Q117: Measure of income tax deduction on a

Q120: Doug inherited his mother's bedroom furniture worth