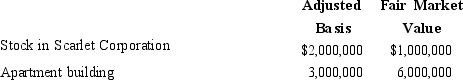

Liam and Isla are husband and wife and have always lived in a community property state. At the time of Isla's prior death, part of their community property includes: Under Isla's will, all of her property passes to Liam. After Isla's death, Liam's income tax basis in this property is:

Under Isla's will, all of her property passes to Liam. After Isla's death, Liam's income tax basis in this property is:

Definitions:

Job Enlargement

Adding more tasks to a job to increase the job cycle and draw on a wider range of employee skills.

Autonomy

The degree of freedom and independence an employee has in their job to make decisions and control their work processes.

Evaluate Job Performance

The process of assessing how well an employee performs their job duties and responsibilities.

Environmental Considerations

The influence of the external environment on job design; includes employee ability, availability, and social expectations.

Q13: Van takes out an insurance policy on

Q20: Eric, age 80, has accumulated about $6

Q33: Some states impose inheritance taxes, but the

Q49: Compute the undervaluation penalty for each of

Q65: At the time of his death, Al

Q82: Which, if any, are characteristics of the

Q105: The accuracy-related penalties typically relate to on

Q142: Community property

Q150: What are the advantages of § 6166

Q206: A surviving spouse's share of the community