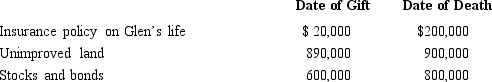

In 2012, Glen transferred several assets by gift to different persons. Glen dies in 2014. Information regarding the properties given is summarized below. Fair Market Value The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000. As to these transactions, Glen's gross estate must include:

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000. As to these transactions, Glen's gross estate must include:

Definitions:

Free Market

An economic system in which prices are determined by unrestricted competition between privately owned businesses.

Final Allocation

The ultimate distribution of goods, services, or resources among different parties or locations.

Corrective Tax

A tax designed to encourage or discourage certain behaviors or activities by including the cost of externalities, aimed at correcting market outcomes to reflect social costs or benefits.

Supply Curve

A graphical representation showing the relationship between the quantity of a good supplied and its price.

Q42: George is running for mayor of Culpepper.

Q46: A taxpayer's return might be selected for

Q57: Using his own funds, Horace establishes a

Q59: Sixty percent of the income received by

Q68: An individual is not subject to an

Q68: The rental income of a trust usually

Q122: Attorneys are allowed an "attorneyclient privilege" of

Q130: A trust that is required to distribute

Q147: Harry and Brenda are husband and wife.

Q147: When a trust operates a trade or