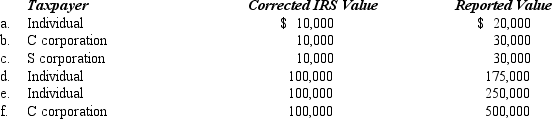

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property. In each case, assume a marginal Federal income tax rate of 35%.

Definitions:

Organizational Structure

Refers to the way in which a company or organization is arranged, including its hierarchies, communication systems, and distribution of responsibilities.

Conformity To Gender Roles

The extent to which individuals adhere to the culturally defined expectations and behaviors associated with their gender.

Intimacy

The close familiarity or friendship that fosters a deep emotional connection between people.

Risk-Taking Behavior

Actions that involve exposure to danger, harm, or loss, but are pursued for potential rewards.

Q5: Darlene holds a special power of appointment

Q6: Sales/use tax nexus is established for the

Q19: Which of the following taxes are included

Q60: In April 2013, Tim makes a gift

Q61: Theater, Inc., an exempt organization, owns a

Q63: Which of the following statements regarding the

Q81: Owning a tablet computer that is used

Q120: Compute the overvaluation penalty for each of

Q137: In what manner does the tax law

Q178: The purpose of the excise tax imposed