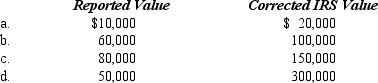

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate. In each case, assume a marginal Federal estate tax rate of 40%.

Definitions:

Emotional Intelligence

The capacity to comprehend, utilize, and control one's emotions constructively to mitigate stress, facilitate effective communication, empathize with others, and navigate obstacles.

Noncognitive Skills

Traits and behaviors that are not directly related to intellectual abilities but are important for personal development, social interactions, and academic and workplace success, such as emotional regulation and persistence.

Environmental Demands

The pressures and requirements placed on an individual or organization by the external surroundings, including social, economic, and ecological factors.

Ohio State Leadership Model

A behavioral leadership model developed from studies at Ohio State University, focusing on two dimensions of leadership behavior: consideration and initiating structure.

Q4: Revenue generated by an exempt organization from

Q67: For Federal estate tax purposes, the gross

Q69: Parent Corporation owns all of the stock

Q92: To maintain exempt status, an organization must

Q106: About % of all Forms 1040 are

Q115: The tax preparer penalty for taking an

Q123: Juanita, who is subject to a 40%

Q132: § 501(h) election<br>A) Carries on a trade or

Q142: Cheng filed an amended return this year,

Q154: Which of the following is not immune