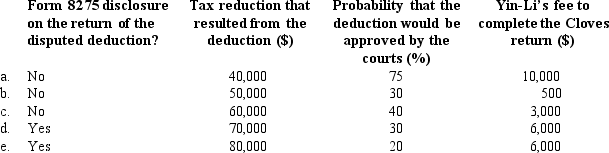

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

SEC Rule 10b-5

A regulation enacted by the U.S. Securities and Exchange Commission that prohibits fraud in the sale of securities.

Intentional Conduct

Actions undertaken with awareness and deliberate intent, often relevant in establishing liability or culpability in legal cases.

Negligence

A lack of exercising the level of caution that a reasonably careful person would have shown in similar circumstances, leading to injury or damage.

Protected Individuals

Persons who are afforded special protections under the law, often due to their status, such as minors, disabled persons, or protected witnesses.

Q3: In the "rate reconciliation" of GAAP tax

Q5: Troy, an S corporation, is subject to

Q39: Bert Corporation, a calendar-year taxpayer, owns property

Q43: Whether an organization is a qualified charity

Q58: Which of the following requirements must be

Q71: Phyllis, Inc., earns book net income before

Q127: A timely issued disclaimer by an heir

Q132: The tax levied by a state usually

Q133: A % penalty may result when the

Q173: Undervaluation of a reported item.