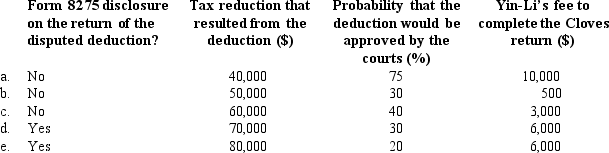

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Res Ipsa Loquitur

A legal doctrine which allows plaintiffs to prove negligence on the basis of the very nature of an accident or injury occurring, suggesting the defendant's responsibility even without direct evidence of negligence.

Overpressurized

A state where pressure in a system exceeds its designed limits, potentially leading to failure or hazard.

Bottler

A company or entity that places beverages into bottles for distribution and sale.

Restatement Second Torts

A legal treatise that summarizes the general principles of American tort law, including definitions of torts and the standards of liability.

Q14: Tenancy by the entirety

Q22: What are the excise taxes imposed on

Q55: Repatriating prior year earnings from a foreign

Q72: The excise tax imposed on private foundations

Q104: Unless the "widely available" provision is satisfied,

Q110: Circular 230 requires that the tax practitioner

Q124: A gift will cause income tax consequences

Q147: Harry and Brenda are husband and wife.

Q158: During an audit, the IRS might require

Q166: § 501(h)<br>A) Exempt organization under § 501(c)(3).<br>B) May not