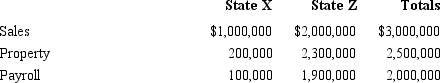

Chipper Corporation realized $1,000,000 taxable income from the sales of its products in States X and Z. Chipper's activities establish nexus for income tax purposes only in Z, the state of its incorporation. Chipper's sales, payroll, and property among the states include the following.  X utilizes a salesonly factor in its threefactor apportionment formula. How much of Chipper's taxable income is apportioned to X?

X utilizes a salesonly factor in its threefactor apportionment formula. How much of Chipper's taxable income is apportioned to X?

Definitions:

Cortisol

A steroid hormone in the body, often released in response to stress and used as a marker for stress levels.

Corticotropin-Releasing Hormone

A hormone involved in the stress response, stimulating the pituitary gland to release adrenocorticotropic hormone, which then promotes the production of cortisol by the adrenal glands.

Adrenocorticotropic-Releasing Hormone

A hormone produced in the hypothalamus that stimulates the release of cortisol from the adrenal gland, playing a key role in the body's response to stress.

Epinephrine

Also known as adrenaline, it's a hormone and neurotransmitter involved in the "fight or flight" response.

Q15: By making a water's edge election, the

Q29: Net Corporation's sales office and manufacturing plant

Q53: Minnie, a calendar year taxpayer, filed a

Q71: § 501(c)(6) business league<br>A) League of Women Voters.<br>B) Teachers’

Q84: In arriving at the taxable estate, expenses

Q99: Property taxes generally are collected by local

Q109: Pearl Inc., a tax-exempt organization, leases land,

Q129: Apportionment is a means by which a

Q147: Made life insurance payable to children.

Q168: Donee's basis for loss.