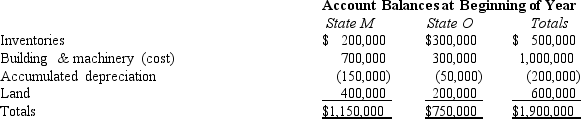

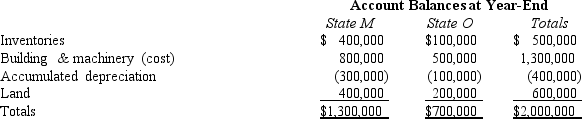

Valdez Corporation, a calendar-year taxpayer, owns property in States M and O. Both M and O require that the average value of assets be included in the property factor. M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.

Valdez's O property factor is:

Valdez's O property factor is:

Definitions:

1980s

A decade marked by significant economic, political, and cultural events, including the end of the Cold War, the rise of neoliberal economic policies, and significant technological advancements.

Automatic Stabilizer

Measures and plans intended to balance the ups and downs in a country's economy without needing more government involvement.

Welfare Payments

Government-provided financial aid to individuals or families, intended to support those who are unable to support themselves.

Income Tax

A tax levied by governments on individuals' or entities' income, including earnings from employment, business profits, and investments.

Q5: If the unrelated business income of an

Q25: Which statement is incorrect as to the

Q30: C corporations and their shareholders are subject

Q32: Among the assets included in Taylor's gross

Q39: A § 501(c)(3) organization exchanges its membership

Q42: George is running for mayor of Culpepper.

Q72: Matt and Patricia are husband and wife

Q89: A state sales/use tax is designed to

Q124: If the taxpayer refuses to pay an

Q184: Given the following transactions for the year,