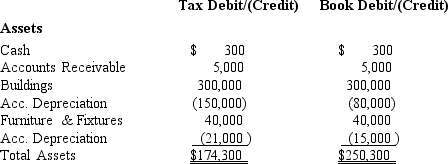

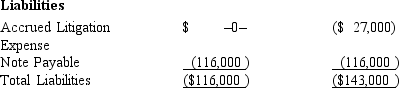

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 35% corporate tax rate and no valuation allowance.

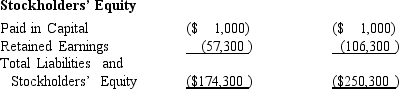

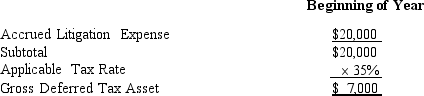

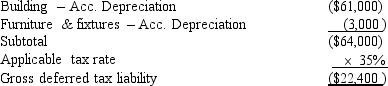

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences. It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals and entertainment expense. Calculate Black's current tax expense.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences. It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals and entertainment expense. Calculate Black's current tax expense.

Definitions:

Nuclear Membrane

A double lipid bilayer that encloses the nucleus in eukaryotic cells, separating the contents of the nucleus from the cytoplasm.

Gene Therapy

A medical treatment that involves altering the genes inside a patient's cells to treat or prevent disease.

Congenital Disorder

A medical condition that is present at birth, which can result from genetic abnormalities, the intrauterine environment, or unknown factors.

BRCA Analysis

Genetic testing that looks for mutations in the BRCA1 and BRCA2 genes, known markers for increased risk of breast and ovarian cancers.

Q17: In most states, a limited liability company

Q24: An S corporation with substantial AEP records

Q31: An exempt organization is located in the

Q44: Jogg, Inc., earns book net income before

Q51: George (a calendar year taxpayer) owns a

Q71: Negligence in filing a return.

Q102: A taxpayer penalty may be waived if

Q107: Some fringe benefits always provide a double

Q130: A limited partnership offers all partners protection

Q184: Given the following transactions for the year,