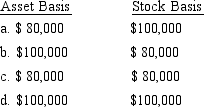

Trolette contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a C corporation and the transaction qualifies under § 351, the corporation's basis for the property and the shareholder's basis for the stock are:

E) None of the above.

Definitions:

Legal Risk

The potential for financial losses or other negative consequences resulting from legal actions, non-compliance with laws, or failure to enforce contractual obligations.

Serious Incident

An event or situation that has a significant negative impact on the safety, security, or operation of an organization or community.

Search Firm

A specialized company engaged in the business of recruiting employees for organizations, typically focusing on middle to upper-level positions.

Recruiting

The process of attracting, identifying, and selecting suitable candidates for job vacancies.

Q7: Optional adjustment election

Q15: Chris, the sole shareholder of Taylor, Inc.,

Q23: Restful, Inc., a § 501(c)(3) exempt organization,

Q26: Hopper Corporation's property holdings in State E

Q30: A § 501(c)(3) organization that otherwise would

Q65: In conducting multistate tax planning, the taxpayer

Q80: WillCo completes the construction of production facilities

Q83: Any distribution made by an S corporation

Q96: Kim Corporation, a calendar year taxpayer, has

Q150: In the broadest application of the unitary