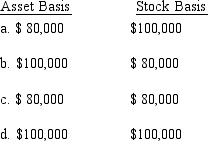

Alanna contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

E) None of the above.

Definitions:

Electronic Portfolios

Collections of digital artifacts and evidence of an individual's achievements, skills, experiences, and learning, often used for education, assessment, or career development.

Application Message

Communication that typically serves a specific purpose, such as applying for a job, school, or grant, often requiring a particular format or structure.

Original Expressions

Unique or novel phrases, ideas, or artistic creations not derived from something else, showcasing creativity.

Professional Portfolio

A collection of work samples showcasing skills, accomplishments, and experiences, typically used in job applications or professional self-promotion.

Q14: Melanie and Sonny form Bird Enterprises. Sonny

Q23: A deferred tax liability represents a current

Q40: South, Inc., earns book net income before

Q56: John wants to buy a business whose

Q103: The Section 179 expense deduction is a

Q123: Techniques that can be used to minimize

Q124: Which of the following activities is not

Q129: The trade or business of selling merchandise

Q162: Factors that should be considered in making

Q169: The legal form of Edith and Fran's