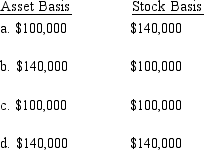

Martin contributes property with an adjusted basis of $100,000 and a fair market value of $140,000 to a newly formed business entity. If the entity is an S corporation and the transaction qualifies under § 351, the S corporation's basis for the property and the shareholder's basis for the stock are:

E) None of the above.

Definitions:

Income Statement

A financial document that reports a company's revenues, expenses, and net income over a specific period.

Percentage of Sales Method

A financial forecasting model that assumes certain expenses and incomes will vary directly with sales.

Allowance for Doubtful Accounts

A contra-asset account that estimates the portion of accounts receivable which may not be collectible.

Bad Debts Expense

An expense account reflecting estimated uncollectible accounts receivable.

Q7: Robin, Inc., an exempt organization, acquired a

Q22: Which item has no effect on an

Q32: The passive investment income of an S

Q33: George is planning to retire from the

Q45: If an exempt organization distributes "lowcost items"

Q58: Active member of LLC

Q71: Limited liability partnership

Q94: The League of Women Voters is a

Q101: During the current tax year, Jordan and

Q117: S corporations are treated as partnerships under