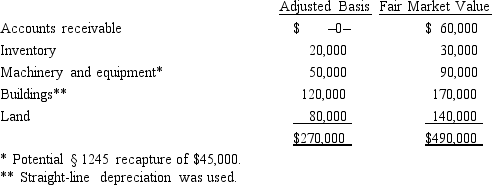

Mr. and Ms. Smith's partnership owns the following assets:  Mr. and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Mr. and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Perceptual Agnosia

A condition in which a person can see objects but cannot recognize them.

Perceptual Inversion

Perceptual Inversion describes a visual phenomenon where an image is seen as upside down or reversed in orientation due to certain manipulation or conditions.

Just Noticeable Difference

The smallest difference in intensity or stimulus strength that a human can detect between two stimuli, also known as the difference threshold.

Decibels

A unit of measurement used to express the intensity of sound, indicating the pressure level of sound waves.

Q18: In determining a corporation's taxable income for

Q46: An estate may be a shareholder of

Q53: When loss assets are distributed by an

Q57: Sole proprietorship

Q63: In a proportionate nonliquidating distribution of his

Q73: Tax on jeopardizing investments

Q97: Well, Inc., a private foundation, makes a

Q109: An S shareholder's basis is increased by

Q134: Zhao Company sold an asset on the

Q151: Amber, Inc., has taxable income of $212,000.