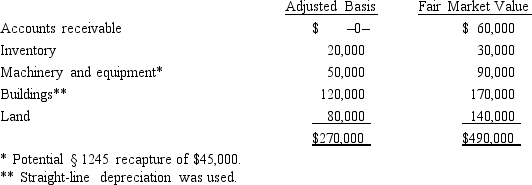

Kristine owns all of the stock of a C corporation which owns the following assets:  Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Seminal Vesicle

The seminal vesicles are a pair of glands in males that secrete a significant portion of the fluid that becomes semen, providing nutrients for sperm and enhancing their motility.

Uterus

A female reproductive organ where the development of the fetus takes place during pregnancy.

Yolk Sac

An extra-embryonic membrane that provides nutrients to the early embryo; it is a critical structure in the development of many vertebrates.

Chorion

The outermost fetal membrane in many vertebrates, including humans, contributing to the formation of the placenta.

Q39: Which statement is incorrect with respect to

Q40: Which of the following statements is correct

Q49: Beach, Inc., a domestic corporation, owns 100%

Q71: NOL carryovers from C years can be

Q88: The JIH Partnership distributed the following assets

Q117: Do the § 465 atrisk rules apply

Q118: Disguised sale

Q123: § 501(c)(4) civic league<br>A) League of Women Voters.<br>B) Teachers’

Q149: The Dispensary is a pharmacy that is

Q170: An S corporation is not subject to