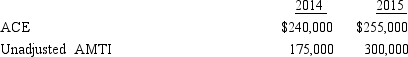

Duck, Inc., is a C corporation that is not eligible for the small business exception to the AMT. Its adjusted current earnings (ACE) and unadjusted alternative minimum taxable income (unadjusted AMTI) for 2014 and 2015 are as follows:

Calculate the amount of the ACE adjustment for 2014 and 2015.

Calculate the amount of the ACE adjustment for 2014 and 2015.

Definitions:

Biomedical Analyses

The examination of biological samples to diagnose disease, evaluate the effectiveness of treatments, or for research purposes.

Large Data Sets

Refers to exceptionally large volumes of data, which cannot be analyzed or handled with traditional data processing tools.

Family Health Histories

A record of the diseases and health conditions present in a person's family, used to assess genetic risks and inform healthcare decisions.

Clinical Practice

The application of medical and health knowledge and skills to the care of patients.

Q27: Devon owns 40% of the Agate Company

Q27: Which of the following statements is not

Q92: The corporation has a greater potential for

Q98: Under the UDITPA's concept, sales are assumed

Q102: Certain § 501(c)(3) exempt organizations are permitted

Q135: Distribution of cash of $60,000 for a

Q147: Lisa is considering investing $60,000 in a

Q151: Form 990-PF.<br>A) Exempt from tax on unrelated business.<br>B) Inappropriate

Q155: Kentwood Rodeo Club<br>A) Exempt organization under § 501(c)(3).<br>B) May

Q167: Boot Corporation is subject to income tax