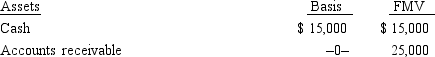

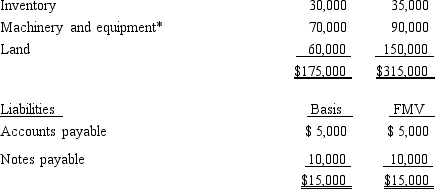

Ralph owns all the stock of Silver, Inc., a C corporation for which his adjusted basis is $225,000. Ralph founded Silver 12 years ago. The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Ralph has agreed to sell the business to Marilyn and they have agreed on a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket, and Silver is in the 34% tax bracket.

a. Advise Ralph on whether the form of the sales transaction should be a stock sale or an asset sale.

b. Advise Marilyn on whether the form of the purchase transaction should be a stock purchases or an asset purchase.

Definitions:

Emotional Cues

Subtle signals indicating someone's emotional state, often communicated through facial expressions, voice tone, or body language.

Attraction

In social psychology, an attitude of liking or disliking (negative attraction).

Fear Appeal

A persuasive communication strategy that aims to elicit fear in order to influence attitudes, intentions, and behaviors.

Persuasive Communication

The art of using language, imagery, and other modes of expression to influence people's attitudes, beliefs, or actions.

Q9: A partnership's allocations of income and deductions

Q14: Guaranteed payment

Q19: Which of the following taxes are included

Q46: Cassandra is a 10% limited partner in

Q69: A distribution from OAA is taxable.

Q70: Distribution of cash of $60,000 for a

Q123: Separately stated items are listed on Schedule

Q129: The trade or business of selling merchandise

Q142: For an exempt organization to be subject

Q176: Which of the following exempt organizations are