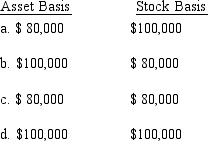

Alanna contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

E) None of the above.

Definitions:

Operations Management

A field of management concerned with designing and controlling the production process and redesigning business operations in the production of goods or services.

Hand Labor

Work performed manually without the use of machines or technology, often requiring physical effort or skill.

Machine Shops

Workshops or facilities equipped with machine tools for making or repairing machinery or machine parts, involving various machining processes.

Hawthorne Studies

A series of studies conducted to examine how various aspects of the work environment, such as lighting and work hours, affect worker productivity, emphasizing the social and psychological factors.

Q15: Which of the following transactions will not

Q22: A partnership continues in existence unless one

Q48: Debt-financed property consists of all real property

Q86: The MOG Partnership reports ordinary income of

Q94: The League of Women Voters is a

Q104: Discuss two ways that an S election

Q129: Which of the following statements is incorrect?<br>A)

Q135: When compared to a partnership, what additional

Q140: Mercedes owns a 30% interest in Magenta

Q147: The individual seller of a used auto