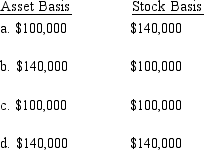

Martin contributes property with an adjusted basis of $100,000 and a fair market value of $140,000 to a newly formed business entity. If the entity is an S corporation and the transaction qualifies under § 351, the S corporation's basis for the property and the shareholder's basis for the stock are:

E) None of the above.

Definitions:

Capacity

The maximum amount that something can contain or produce.

Bits of Information

The smallest units of data in computing, representing a binary choice between two alternatives, such as 0 or 1.

Primacy Effect

A cognitive phenomenon where the first items presented in a series are more likely to be remembered than items presented later on.

First Impressions

First Impressions are the initial thoughts and judgments one forms about another person or situation, often based on limited information but impactful on subsequent perceptions.

Q17: In a proportionate liquidating distribution, Sara receives

Q51: Items that are not required to be

Q51: S corporation

Q97: C corporation

Q107: On a partnership's Form 1065, which of

Q123: Separately stated items are listed on Schedule

Q128: A partnership has accounts receivable with a

Q138: Some taxation rules apply to an S

Q140: A state sales tax usually falls upon:<br>A)

Q154: Which of the following is not immune