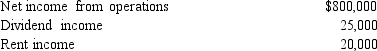

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity. Trout's taxable loss for the current year is $250,000. During the year, Catfish receives a $60,000 cash distribution from Trout. Other relevant data for Catfish are as follows:  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Western Culture

A societal framework largely derived from the traditions of European civilizations, characterized by its philosophies, values, and practices.

Triangular Theory Of Love

A psychological theory proposed by Robert Sternberg that suggests love is composed of three components: intimacy, passion, and commitment.

Paternity Certainty

The degree of assurance or confidence that a male has regarding his biological relationship to a child.

Happy Couples

Refers to partners in a romantic relationship who experience a high level of mutual satisfaction, understanding, and emotional connection.

Q9: Your client is a C corporation that

Q13: José Corporation realized $900,000 taxable income from

Q23: Federal general business credit.

Q27: Under P.L. 86-272, which of the following

Q27: In a proportionate liquidating distribution in which

Q42: If an individual contributes an appreciated personal

Q74: A partnership will take a carryover basis

Q96: Limited partnership

Q110: Do the § 465 atrisk rules treat

Q127: Normally a distribution of property from a