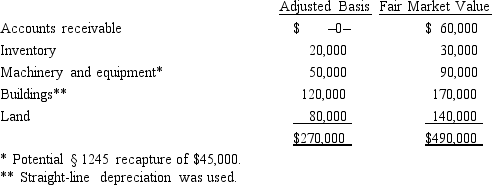

Mr. and Ms. Smith's partnership owns the following assets:  Mr. and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Mr. and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Tacit Collusion

A form of collusion in which businesses subtly coordinate actions without explicit agreement, aiming to raise prices or stabilize market conditions.

Legal

Pertains to matters governed by law, statutes, or regulations and recognized or enforced by a judicial system.

Tit-For-Tat Strategy

A cooperative, reciprocative strategy in game theory where an entity responds to an opponent's action with similar action.

Pricing Strategy

The approach a company uses to determine the best price for its products or services to maximize profits and meet customer expectations.

Q35: Black, Inc., is a domestic corporation with

Q38: Even though a church is not required

Q41: Membership lists<br>A) Distribution of such items is not

Q61: "Temporary differences" are booktax differences that appear

Q73: Tax-exempt income is not separately stated on

Q76: Jeremy is an active partner who owns

Q102: Several years ago, the Jaymo Partnership purchased

Q153: From the viewpoint of the entity and

Q154: Alomar, a cash basis S corporation in

Q171: Your client, Hamlin Industries, wants to reduce