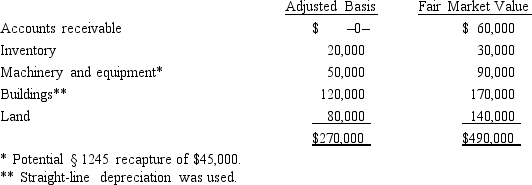

Kristine owns all of the stock of a C corporation which owns the following assets:  Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Intercostal Veins

Veins located between the ribs that drain blood from the chest wall and muscles back to the heart.

Intercostal Muscles

Muscles located between the ribs that assist with the breathing process by expanding and contracting the chest cavity.

Azygous Vein

A vein running up the right side of the thoracic vertebral column that drains blood from the chest wall and upper limbs back to the heart.

Subscapular

Pertaining to beneath the scapula or shoulder blade, often referring to muscles or vessels in that area.

Q3: Mandatory step down

Q9: Your client is a C corporation that

Q12: An S corporation is limited to a

Q16: Disproportionate distribution

Q32: In the year a donor gives a

Q75: S corporation status always avoids double taxation.

Q81: Owning a tablet computer that is used

Q102: Albert and Elva each own 50% of

Q135: Hope, Inc., an exempt organization, owns a

Q176: Which of the following exempt organizations are