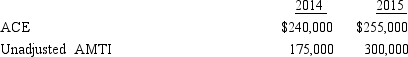

Duck, Inc., is a C corporation that is not eligible for the small business exception to the AMT. Its adjusted current earnings (ACE) and unadjusted alternative minimum taxable income (unadjusted AMTI) for 2014 and 2015 are as follows:

Calculate the amount of the ACE adjustment for 2014 and 2015.

Calculate the amount of the ACE adjustment for 2014 and 2015.

Definitions:

Report Format

The structured way in which information is organized and presented in a document, often including sections like introduction, body, and conclusion.

Discussion of Findings

The section of a research paper or report where results are interpreted, implications are discussed, and conclusions are drawn.

Functional Heading

Categorization used in documents or presentations to organize information based on function or role rather than chronology or hierarchy.

Observation

The process of closely monitoring or watching something or someone, often for the purpose of gathering data or understanding behavior.

Q28: At the beginning of the year, Heather's

Q70: Yates Corporation elects S status, effective for

Q74: In determining taxable income for state income

Q91: Help, Inc., a tax-exempt organization, incurs lobbying

Q107: On a partnership's Form 1065, which of

Q114: An S corporation recognizes a on any

Q116: Built-in gains tax<br>A) Gross receipts from royalties, passive

Q118: Cash basis accounts receivable.

Q137: Beige, Inc., has 3,000 shares of stock

Q158: If an S corporation has C corporation