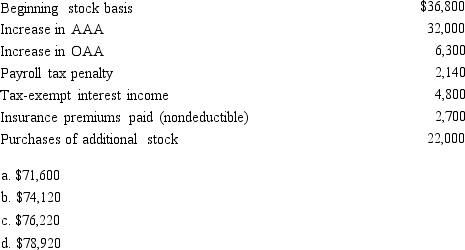

You are given the following facts about a 40% owner of an S corporation, and you are asked to prepare her ending stock basis.

Definitions:

Workers

Individuals engaged in any form of labor, whether employed by organizations, self-employed, or working as freelancers, contributing to the production of goods and services.

Producer Surplus

The difference between the amount a producer is paid for a good compared to the minimum amount they would be willing to accept for it, a measure of producer welfare.

Price

The sum of money needed to buy a product, service, or commodity.

Quantity

The amount or number of a material or immaterial good considered as a unit or in discrete amounts.

Q5: Capital intensive partnership

Q12: ASC 740 (FIN 48) addresses how an

Q24: A deferred tax asset is the expected

Q35: Depreciation recapture

Q44: In 2013, George renounces his U.S. citizenship

Q46: An estate may be a shareholder of

Q56: Where the S corporation rules are silent,

Q101: Which of the following statements regarding income

Q124: Blue, Inc., has taxable income before salary

Q175: Youngster, Inc., a U.S. corporation, earns $20,000