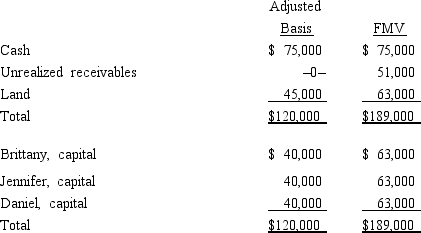

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Definitions:

Saving

The portion of income not spent on consumption, often put aside for future use or investment.

Disposable Income

The amount of money an individual or household has available to spend or save after income taxes have been deducted.

Disposable Income

Money that becomes available for household savings and expenditures after income taxes are subtracted.

MPS

Marginal Propensity to Save, which is the proportion of an increase in income that is saved rather than spent on consumption.

Q48: GoldCo, a U.S. corporation, incorporates its foreign

Q52: The accumulated earnings tax rate in 2014

Q84: The JPM Partnership is a US-based manufacturing

Q91: Given the following information, determine if FanCo,

Q117: Keep Corporation joined an affiliated group by

Q119: Form 1023<br>A) Return of Private Foundation.<br>B) Application for Recognition

Q122: A partnership is required to make a

Q134: Your client holds foreign tax credit (FTC)

Q142: The § 465 atrisk provision and the

Q159: Form 1024<br>A) Return of Private Foundation.<br>B) Application for Recognition