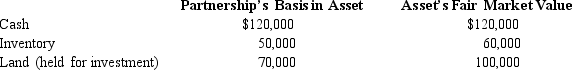

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $200,000. On that date, she receives a proportionate nonliquidating distribution of the following assets:

a. Calculate Karli's recognized gain or loss on the distribution, if any.

b. Calculate Karli's basis in the inventory received.

c. Calculate Karli's basis in land received. The land is a capital asset.

d. Calculate Karli's basis for her partnership interest after the distribution.

Definitions:

Persuade

The act of convincing someone to do or believe something through reasoning or argument.

Writing Process

A series of steps that writers follow to plan, draft, revise, and finalize their work.

Persuasive Messages

Communications designed to convince or influence the audience to adopt a certain viewpoint or take specific action.

Essential Strategies

Fundamental plans or approaches necessary to achieve a particular goal or outcome.

Q8: Which of the following items are not

Q13: Black, Inc., is a domestic corporation with

Q14: All members of an affiliated group have

Q20: General partner

Q44: Discuss how a parent corporation computes its

Q47: Which could constitute a second class of

Q58: When a consolidated NOL is generated, each

Q100: Which statement is incorrect with respect to

Q101: Which item does not appear on Schedule

Q136: A corporation may alternate between S corporation