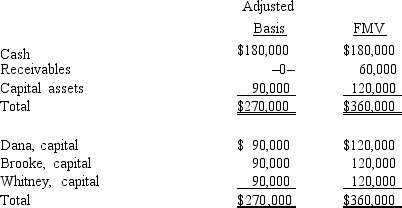

The December 31, 2014, balance sheet of DBW, LLP, a service-providing partnership is as follows:

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2014, partner Dana (who is an active managing partner in the partnership) receives a distribution of $120,000 cash in liquidation of her partnership interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $90,000. How much is Dana's gain or loss on the distribution and what is its character?

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2014, partner Dana (who is an active managing partner in the partnership) receives a distribution of $120,000 cash in liquidation of her partnership interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $90,000. How much is Dana's gain or loss on the distribution and what is its character?

Definitions:

Income Elasticity

A measure of how the demand for a good or service changes in response to changes in income.

Price Inelastic

Refers to a situation where demand or supply for a product is relatively unresponsive to price changes.

Price Elasticity

It quantifies the sensitivity of the quantity demanded or supplied to alterations in its price.

Midpoint Formula

A mathematical formula used to find the exact middle point between two points on a line segment, commonly used in economics to calculate the elasticity of demand or supply.

Q3: On a corporate Form 1120, Schedule M-1

Q26: An S election made before becoming a

Q36: How are deferred tax liabilities and assets

Q73: Precontribution gain

Q82: In a liquidating distribution, a partnership must

Q107: Cindy, a 20% general partner in the

Q117: S corporations are treated as partnerships under

Q127: § 179 deduction

Q144: Consolidated return members determine which affiliates will

Q159: Cooper Corporation joined the Duck consolidated Federal