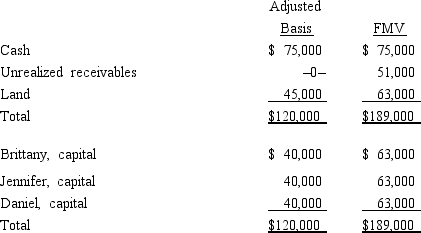

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Definitions:

Repudiated

To reject, refuse to accept, or be associated with, often in relation to a contract or agreement.

Excavation Corporation

A company engaged in the business of removing earth, rock, or other materials from a site to construct buildings, roads, or to mine resources.

Perfect Tender Rule

a legal principle that requires sellers to deliver goods to buyers exactly as specified in their contract, without any deviations.

Quarantine

The restriction of movement of people or goods, often used to prevent the spread of contagious diseases.

Q9: The calendar year parent and affiliates must

Q13: Which of the following statements about the

Q40: Which of the following statements is correct

Q41: Membership lists<br>A) Distribution of such items is not

Q51: S corporation

Q61: "Temporary differences" are booktax differences that appear

Q67: Dividends received from Murdock Corp., a corporation

Q69: Hot assets

Q70: KeenCo, a U.S. corporation, is the sole

Q78: Consolidated group members each are jointly and