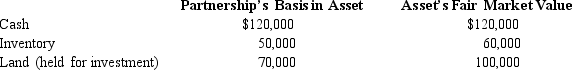

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $200,000. On that date, she receives a proportionate nonliquidating distribution of the following assets:

a. Calculate Karli's recognized gain or loss on the distribution, if any.

b. Calculate Karli's basis in the inventory received.

c. Calculate Karli's basis in land received. The land is a capital asset.

d. Calculate Karli's basis for her partnership interest after the distribution.

Definitions:

Level of Prevention

The strategies implemented to prevent disease or injury, categorized into primary, secondary, and tertiary prevention.

Diabetes

A chronic condition characterized by high blood sugar levels resulting from the body's inability to produce or effectively use insulin.

Cognitive Function

Mental processes that involve the ability to learn, remember, reason, solve problems, make decisions, and pay attention.

Moderate to Vigorous

Describes physical activities that range from moderate intensity, where you can talk but not sing, to vigorous intensity, where talking becomes difficult.

Q9: Amelia, Inc., is a domestic corporation with

Q21: For Federal income tax purposes, a business

Q41: With respect to special allocations, is the

Q47: If a partnership allocates losses to the

Q71: Limited liability partnership

Q88: The amount of a partnership's income and

Q95: Which, if any, of the following can

Q131: Member's operating gains/profits

Q141: In computing consolidated E & P, dividends

Q153: Which item does not appear on Schedule