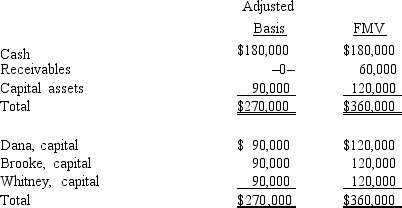

The December 31, 2014, balance sheet of DBW, LLP, a service-providing partnership is as follows:

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2014, partner Dana (who is an active managing partner in the partnership) receives a distribution of $120,000 cash in liquidation of her partnership interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $90,000. How much is Dana's gain or loss on the distribution and what is its character?

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2014, partner Dana (who is an active managing partner in the partnership) receives a distribution of $120,000 cash in liquidation of her partnership interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $90,000. How much is Dana's gain or loss on the distribution and what is its character?

Definitions:

American Federation of Labor

A national federation of labor unions in the United States, founded in 1886, focused on advocating for better working conditions, wages, and rights for workers.

Rural Electrification Agency

Was a U.S. government agency established in 1935 to bring electricity to rural areas, profoundly impacting agricultural productivity and the quality of rural life.

Electricity

A form of energy resulting from the existence of charged particles such as electrons or protons, manifesting as an attraction or repulsion between those particles.

Q23: Which statement is correct with respect to

Q48: Depreciation recapture income is a computed amount.

Q69: Hot assets

Q102: Generally, when a subsidiary leaves an on-going

Q107: Some fringe benefits always provide a double

Q131: When property is contributed to a partnership

Q149: On January 2, 2013, Tim loans his

Q156: The amount of any distribution to an

Q157: To which of the following entities does

Q161: Each of the members of a Federal