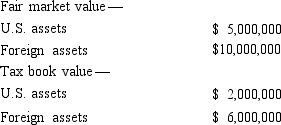

Qwan, a U.S. corporation, reports $250,000 interest expense for the tax year. None of the interest relates to nonrecourse debt or loans from affiliated corporations. Qwan's U.S. and foreign assets are reported as follows.  How should Qwan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

How should Qwan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

Definitions:

Conscious Mind

The aspect of mental processes and activities which a person is aware of at any given time.

Work Area Pollutant

Substances or conditions in a workplace environment that are harmful or potentially harmful to health.

Ergonomically Incorrect Furniture

Furniture that does not conform to ergonomic principles, often leading to discomfort or health issues for the user.

Burnout

A state of physical, emotional, and mental exhaustion caused by prolonged stress or overwork.

Q16: Tax compliance deadlines and recordkeeping

Q38: Besides the statutory requirements for tax-free treatment

Q40: Which of the following statements regarding foreign

Q61: In a limited liability company, all members

Q74: Maximum years for a foreign tax credit

Q87: The ELF Partnership distributed $20,000 cash to

Q97: An item that appears in the "Other

Q116: Cynthia sells her 1/3 interest in the

Q129: Schedules M-1 or M-3

Q152: During 2014, Miles Nutt, the sole shareholder