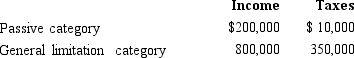

Britta, Inc., a U.S. corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $560,000 (assume a 35% tax rate). What is Britta's U.S. tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $560,000 (assume a 35% tax rate). What is Britta's U.S. tax liability after the FTC?

Definitions:

Grain Cultivation

The farming practice of growing grain crops, such as wheat, corn, barley, and rice, usually for human consumption or livestock feed.

Eighteenth-Century Education

refers to the period of educational practices and institutions that were prevalent in the 1700s, characterized by the growth of private tutors, charity schools, and the beginning of formal schooling systems in various countries.

Elite Families

A group of families considered to be at the top of the social hierarchy due to their wealth, power, or ancestral lineage, often exerting significant influence over political, economic, or societal matters.

Farm Household

Denotes a family unit engaged in agriculture, managing both the production and domestic aspects within a farm setting.

Q3: Income tax treaties may provide for either

Q3: Mandatory step down

Q18: A 50 percentage-point change in ownership that

Q50: In allocating interest expense between U.S. and

Q75: A disproportionate distribution arises when the partnership

Q83: Tammy forms White Corporation in a transaction

Q88: The treatment of group items on a

Q90: Constructive dividends do not need to satisfy

Q107: Cindy, a 20% general partner in the

Q129: Freda was born and continues to live