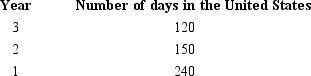

Given the following information, determine whether Greta, an alien, is a U.S. resident for Year 3. Greta cannot establish a tax home in or a closer connection to a foreign country.

Definitions:

Natural Work Units

Groups in a work setting structured around common tasks or processes that allow employees to work effectively toward shared goals with minimal supervision.

Client Relationships

The dynamics and interactions between a business and its clients, emphasizing communication, trust, and satisfaction to foster long-term engagements.

Task Identity

The degree to which a job involves completing a whole, identifiable piece of work from start to finish, providing a sense of accomplishment.

Visible Outcome

Results or effects of actions or activities that are easily observed, quantified, or measured by others, contributing to accountability and evaluation.

Q1: If the successor corporation's currentyear taxable income

Q16: JLK Partnership incurred $6,000 of organizational costs

Q49: Limited partner

Q74: Maximum years for a foreign tax credit

Q87: The ELF Partnership distributed $20,000 cash to

Q96: Which of the following is not typically

Q110: A parent-subsidiary controlled group exists where there

Q116: Which of the following is not a

Q121: Laura is a real estate developer and

Q171: Columbia, Inc., a U.S. corporation, receives a