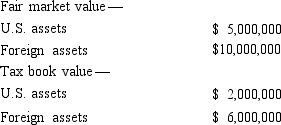

Qwan, a U.S. corporation, reports $250,000 interest expense for the tax year. None of the interest relates to nonrecourse debt or loans from affiliated corporations. Qwan's U.S. and foreign assets are reported as follows.  How should Qwan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

How should Qwan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

Definitions:

Latino/a Values

The beliefs, ethics, and customs traditionally observed and transmitted within Latino communities, often emphasizing family, respect, and community.

Acculturation

The process through which individuals or groups from one culture adopt practices, values, and norms of another culture, often while still retaining aspects of their original culture.

Gender Role Expectations

The social norms and cultural beliefs about the behaviors and attitudes considered appropriate for males and females.

Religiosity

The intensity or expression of religious feelings, practices, or beliefs in an individual's life.

Q6: The amount of gain recognized by a

Q8: All tax preference items flow through the

Q19: An S corporation shareholder's stock basis includes

Q31: In a reorganization, shareholders may exchange preferred

Q66: Present Value Tables needed for this question.

Q67: Dividends received from Murdock Corp., a corporation

Q77: If a partnership earns tax-exempt income, the

Q84: ParentCo and SubCo had the following items

Q129: Schedules M-1 or M-3

Q139: Gain deferral on intercompany transactions