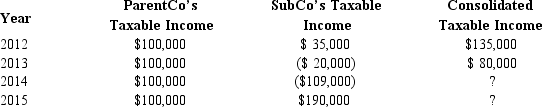

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2012. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  The 2014 consolidated loss:

The 2014 consolidated loss:

Definitions:

Social Loafing

The phenomenon where individuals exert less effort on a task when working in a group compared to when working alone.

Production Matching

A cognitive process where individuals match new information with what they have previously learned or experienced.

Distraction

The process of diverting someone's attention from the intended object of focus to something else.

Social Identity Theory

A theory positing that an individual’s sense of who they are is based on their group membership(s), which shapes their behavior and attitudes.

Q25: Nondeductible meal and entertainment expenses must be

Q39: Hannah, Greta, and Winston own the stock

Q42: Choice of tax year-ends by affiliates

Q53: The U.S. states apply different rules in

Q61: In a limited liability company, all members

Q78: If a parent corporation makes a §

Q79: Your client has operated a sole proprietorship

Q79: Bilateral agreement between two countries related to

Q88: Thrush, Inc., is a calendar year, accrual

Q116: Stacey and Andrew each own one-half of